Industry Report: The Used Heavy Machinery & Truck Market in 2018

A Mascus Report

With over 420,000 used heavy machinery and trucks listed for sale on its website, Mascus is one of the world’s largest online listing website to buy and sell used construction, mining, forestry, agricultural, material handling equipment and commercial transport vehicles. The company was created in year 2001 and operates with 28 offices around the world in 38 languages.

Why this report?

Being a global digital service with a large content listed for sale and with over 2.5 million unique buyers visiting the Mascus website every month, we are able to capture a lot of interesting data. In this study, we have compiled data which gives an overview of the global demand for used heavy machinery and trucks for the year 2018.

This annual report is also intended as an informative summary of the Mascus site performance in the following areas: audience, content and demand. Data for all three sections will provide insights on various dimensions in order to reflect a complete performance outline.

1. Audience overview

Audience is one of our top priorities and we are constantly working on increasing the quality and volume of our web traffic globally. 2018 saw a healthy increase in traffic compared to the previous year which can be translated into an increasing demand and interest in buying used heavy machinery and trucks. In 2018 we saw an increase of 6% in Users and Sessions on Mascus compared to 2017.

“There are now more buyers searching for used heavy machinery and trucks on their mobile devices than on their desktop computer.”

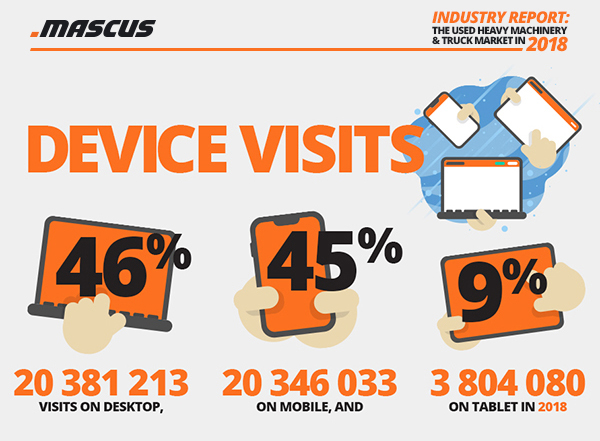

One of the most important metrics we are tracking in traffic is the type of device through which our users reach the site. In line with the global trend, mobile traffic is continuously increasing in the detriment of desktop usage, as buyers find it more convenient to search for used heavy machinery and trucks from their mobile devices. For Mascus, the audience share split for Sessions by device category in 2018 was the following: 45.77% desktop, 45.69% mobile, 8.54% tablet. To put this into a global perspective, the desktop vs mobile vs tablet market share worldwide for 2018 reported by StatCounter was 50.80% mobile, 45.18% desktop, 4.01% tablet.

One significant event for Mascus was that starting with Q2 2018, mobile traffic took the lead and surpassed fixed internet access devices usage, and by the end of the year it went up to 48.62% monthly audience share for mobile Sessions compared to 43.52% desktop Sessions in December. Our responsive website is adapted to offer a seamless experience on all types of devices. Additionally, our mobile app was also launched in Q4 and we expect to see even a further increase in mobile traffic in 2019.

TIP: OEMs, dealers and traders of used equipment should ensure their company website is mobile friendly. Mascus can help you rebuild your used equipment website, find out more info here.

Looking at our users’ location, 81.13% of our Sessions come from Europe, 7.83% from Americas and 7.42% from Asia. Consequently, 19 out of the 20 countries in the following top are from Europe. However, United States is on the third place in terms of Users visiting Mascus site.

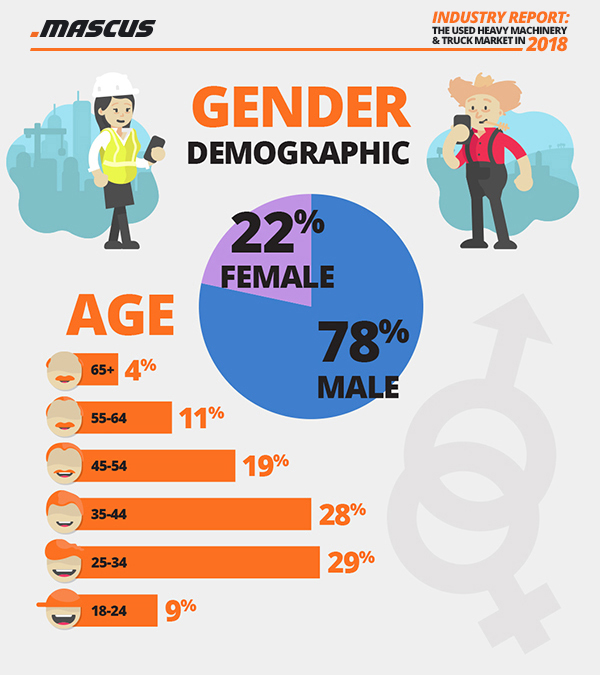

In terms of Demographic measurements, as expected, the large majority of our users are men (78.35%), while less than a quarter are women (21.65%). Both 25-34 and 35-44 age brackets cover each 28% of our users, followed by those between the ages of 45-54 (19%) and 55-64 (11%).

Although most of our audience comes from online, attending live events relevant to the industries we work in and meet our users and customers personally is always a priority for our local teams. In 2018, they were present at 20 important fairs and industry shows with their own stand (Bauma China, Intermat etc.) and visiting another 47 ones. Most of these were located in Europe, however we attended more than 10 in China. Aside from large industry shows, our Mascus representatives are also present at most Ritchie Bros. live auctions all over the world.

2. Content overview

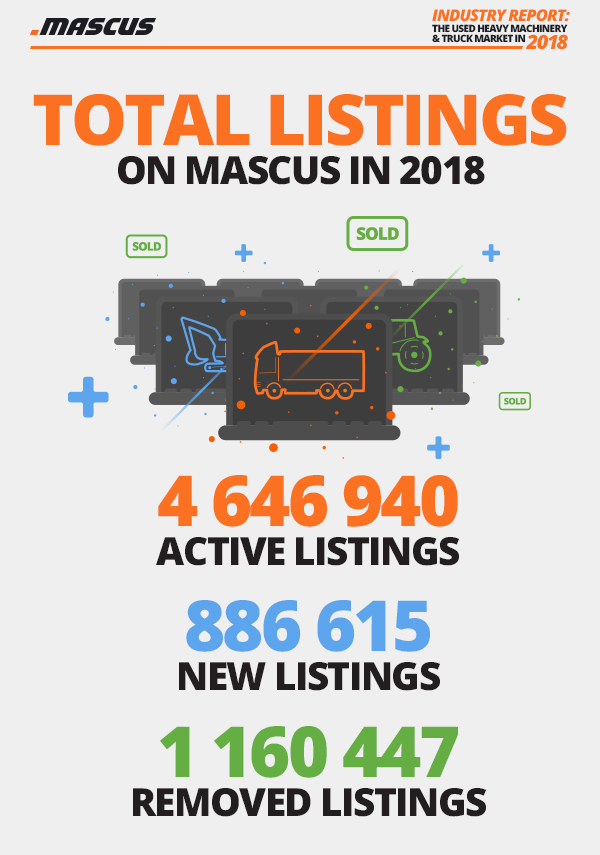

Any business providing online listing services would agree that “content is king”. Therefore, growing our content and offering more choices to potential buyers both locally and internationally is paramount in order to secure a top place in the market. The total number of machines listed on Mascus in 2018 (the monthly average exceeding 400,000 active listings) shows a 7% increase in the used equipment global offer compared to previous year.

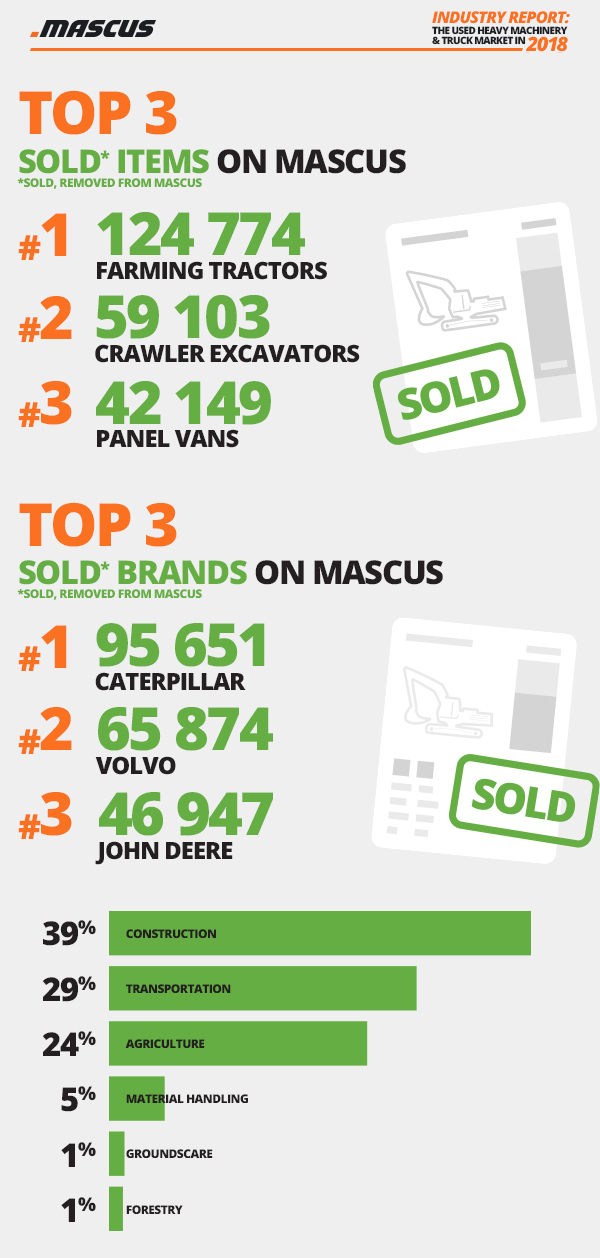

Overall, in 2018 we had a total of 4,646,940 active listings on Mascus (including equipment listed for auction and rental), with 886,615 new listings (newly added each month) and 1,160,447 removed listings (tracked monthly). Removed listings is a strong indicator that the machines were disposed of or sold.

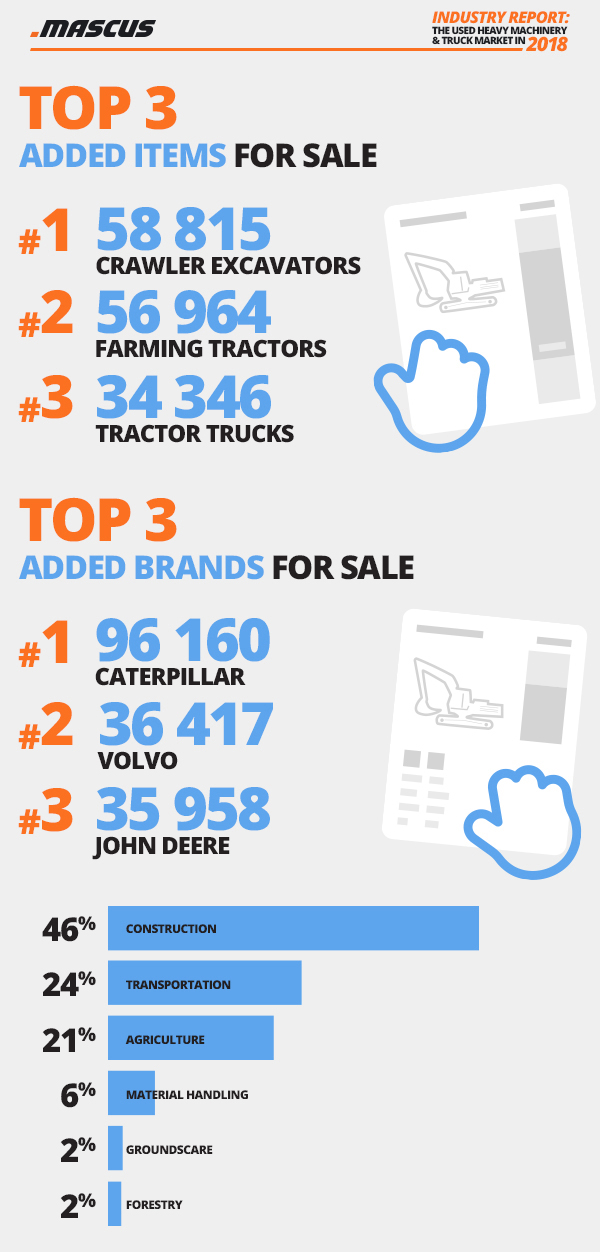

In the following section, we share top 3 new listings and removed listings by machine category and brand on Mascus in 2018. The numbers represent total yearly values. Percentage wise, close to half of the new listings on Mascus in 2018 were used construction equipment items.

Farming tractors and crawler excavators are occupying the first two positions both in new listings and removed listings on Mascus in 2018.

If we investigate the country of origin of active listings in specific sectors, USA, Netherlands and Germany are the countries with the largest offer of used construction equipment. Denmark, Germany, and USA are placing most listings of used agricultural equipment on Mascus, while Spain, Netherlands and Germany are leading in transportation equipment listings. It is worth mentioning that 22% of material handling equipment listings on Mascus originate from Germany.

3. Demand overview

Interested buyers have two options for contacting used equipment sellers on Mascus: sending contact requests by email or calling the seller directly. The amount of email contact requests on Mascus listings during 2018 provides us with valuable insight into the demand for used equipment and reveals which are the most sought after machine types and brands per sector. We have focused on contact request emails rather than on calls, as this metric offers more reliable data for looking into demand statistics. The percentage of email contact requests received on Mascus listings last year represents 22% of the total demand registered last year, the rest being indicators such as 64% of clicks on revealing the seller’s phone number from interested buyers using a desktop, and 14% direct call clicks from mobile users.

In 2018, Mascus users have sent 9% more email contact requests to sellers compared to 2017. The following graphs are based on email contact requests values in 2018.

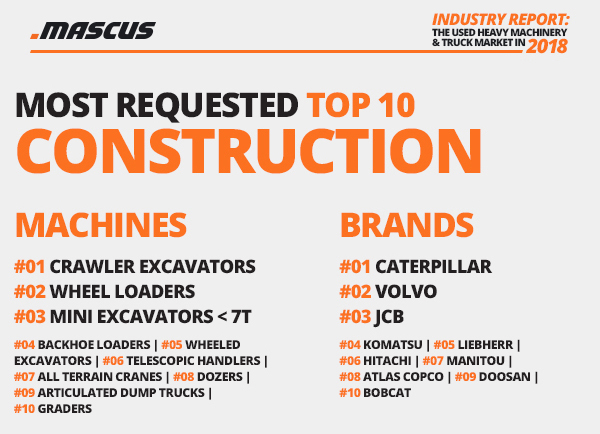

8 out of the 10 most requested machine types on Mascus overall belonged to used construction equipment, which also validates the high percentage of used constructions listings present on Mascus accounting for almost half of the used equipment offer on our site in 2018.

Further in our report, we look into more detail at most requested used equipment machine types and brands per sector in 2018.

Caterpillar held comfortably the top spot in the buyers’ interest for construction equipment brands, followed by Volvo and JCB, while the majority of contact requests received by used construction equipment dealers were for crawler excavators and wheel loaders.

“The majority of contact requests for used agricultural equipment are for tractors, specifically for John Deere models.”

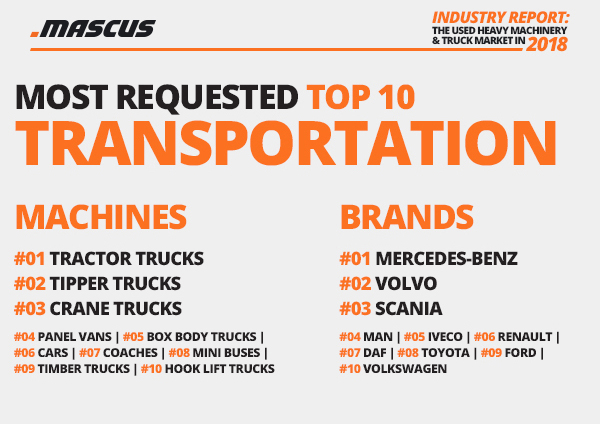

Most info requested for items in transportation sector were on tractor units, while Mercedes-Benz, Volvo and Scania were most preferred brands during 2018.

According to contact request numbers, the highest demand in used forklifts was for Diesel forklift trucks, three times higher compared to the interest in electric forklift trucks. Linde, Hyster and Toyota were the most requested brands in material handling.

In the forestry sector, most buyers were interested in John Deere equipment and usually looking to buy used forwarders or harvesters.

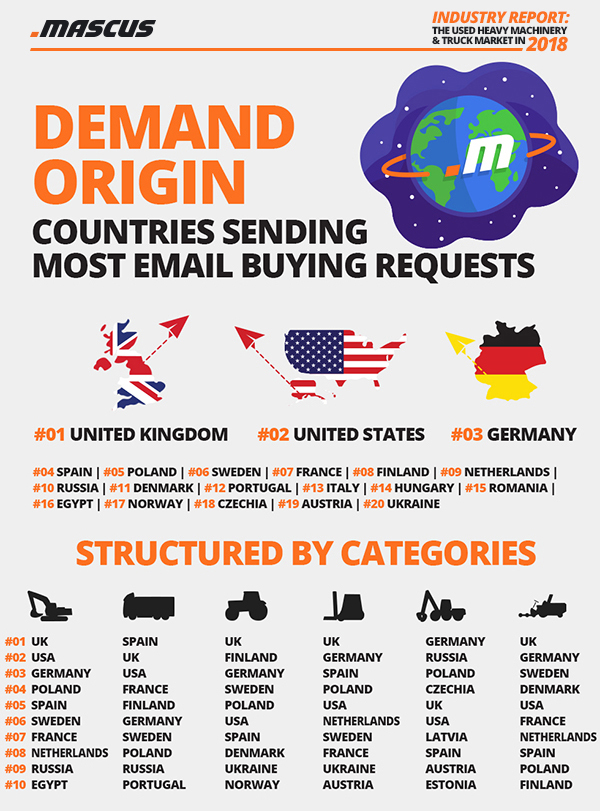

Most email request from buyers came from the following countries (we refer to this as origin of demand):

Top 10 countries sending contact requests emails by sector

Overall, United Kingdom sent out most email contact requests for used equipment in all sectors, twice as many as USA, Germany, Poland or Spain which are next in our top of countries sending most email contact requests in 2018.

If we look specifically into used construction equipment, that’s where most of the UK contact requests were aimed at in 2018. Interestingly, contact requests on used construction equipment coming from Egypt have increased by 57% in 2018 compared to 2017 and pushed Egypt on the tenth place in this top.

United Kingdom was also on the fist place in buyers’ interest for used agricultural equipment. All the large Nordic countries are also present in top 10 signalling a strong demand for agricultural equipment in this region.

Conclusion

To wrap up this report on the used heavy machinery and truck market in 2018, as reflected by values of the traffic, offer and demand registered on Mascus, here are a few conclusions:

- As the used equipment offer continuously grew in 2018, with the number of listings higher by 7% compared to previous year, so did the traffic by 6% and demand with 9% more email contact requests than in 2017.

- The global trend of mobile traffic surpassing the desktop one was recorded on Mascus as well.

- The majority of used heavy equipment listed on Mascus is for the construction sector (about half of the total offer)

- USA and Germany are the countries with most used equipment for sale

- Crawler excavators and tractors are the most sought after used machine types listed on Mascus, while Caterpillar is the most interesting brand of heavy machinery.

Communications Specialist & Social Media Manager at Mascus

Additionally, the annual report is an insightful summary of the Mascus site performance in the following areas: audience, content and demand, to create a complete performance outline of our platform.